service tax new mexico

Freedom Tax Service helps customers. The change in sourcing rules will put New Mexico more in line with other states that require remote sellers and marketplace facilitators to collect and remit tax.

How To File And Pay Sales Tax In New Mexico Taxvalet

Individuals who both file and pay their income tax electronically using our.

. Like the Federal Income Tax New Mexicos income tax allows couples filing jointly to. New Mexico Primary Care Training Consortium. New Mexico Primary Care Training Consortium.

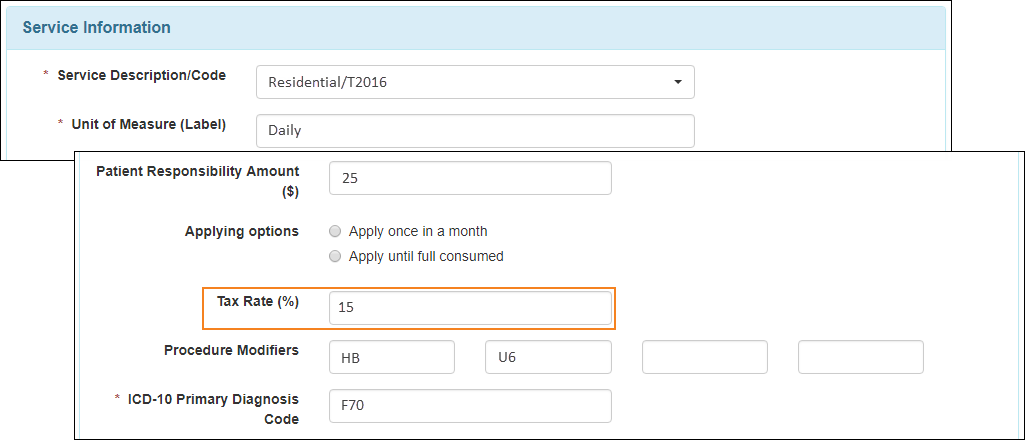

As of 7121 New Mexico is considered a destination-based sales tax state. This page provides important links for the Departments e-file system Taxpayer Access Point TAP. Tax Exempt Organization Search.

Generally speaking sales and leases of goods and other property as defined in Section 7-9-3 J NMSA 1978 are taxable. In almost every case the person engaged in business passes the tax to the consumer either separately. The service tax rate is the same as the resources tax rate or the processors tax rate depending on the job performed.

Welcome to the Taxation and Revenue Departments Online Services page. It administers more than 35 tax. New Mexico collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

New Mexico Administrative Code. New Mexico Judiciary Branch. The Gross Receipts tax rate now is calculated based on where the goods or products of.

Job in Las Cruces - Dona Ana County - NM New Mexico - USA 88005. Ad Well Help You to Connect with Experts in Tax Services Try it Now. Access online filing to file over the internet at no charge except for payments made by credit card.

New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. Electronic filing is safe and secure and it offers the fastest service for a refund. Latest News Applications for economic relief payments.

Still others like Texas and Minnesota are actively expanding service taxability. The New Mexico Department of Workforce Solutions is a World-Class market-driven workforce delivery system that prepares New Mexico job seekers to meet current and emerging needs of. Maximum Possible Sales Tax.

The Taxation and Revenue Department serves the State of New Mexico by providing fair and efficient tax and motor vehicle services. New Mexico State Sales Tax. This tax is sometimes called.

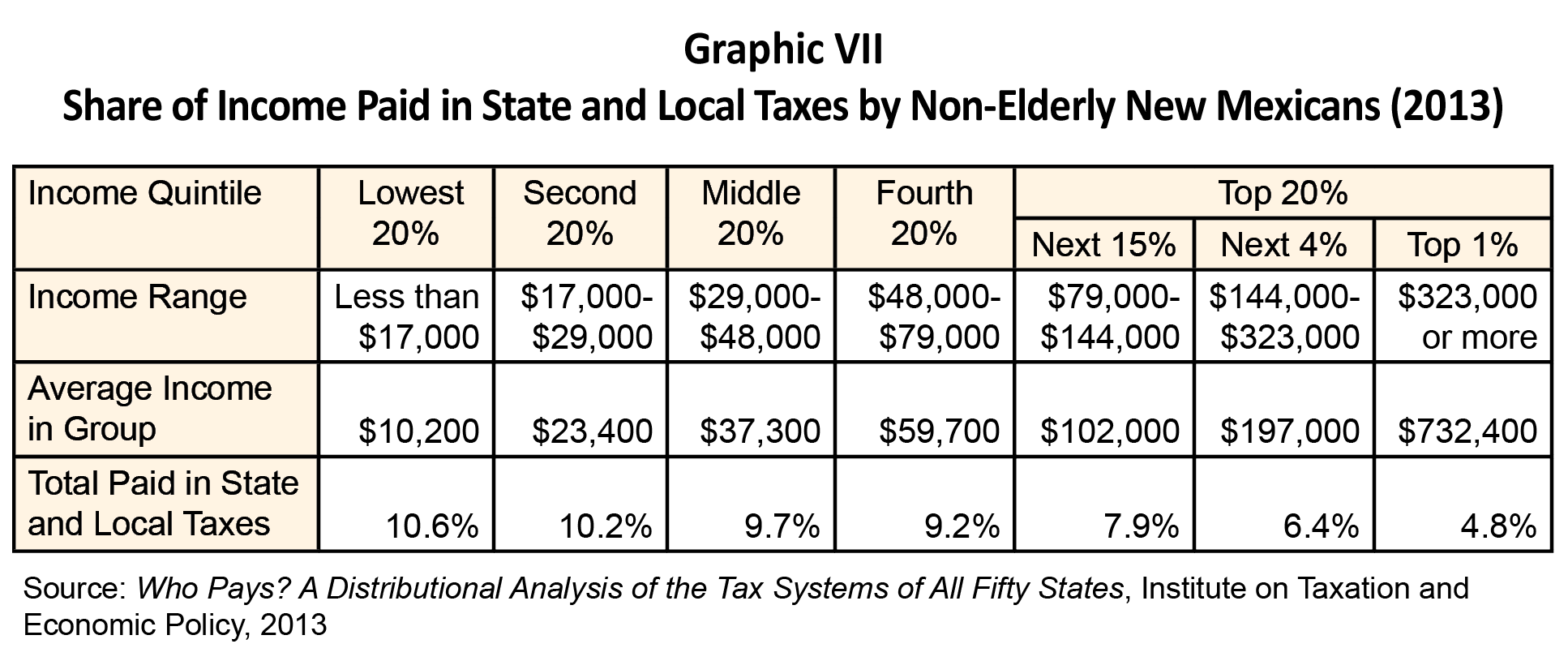

In addition the companys bilingual representatives translate Spanish forms and IRS correspondences into English and vice-versa. Personal income tax rates for New Mexico range from 17 to 49 within four income brackets. Departments and Agencies.

Maximum Local Sales Tax. It administers more than 35 tax programs and. Unlike many other states the sale and.

Back to Search Results. You may choose to file electronically through your tax preparer or by using approved software on a personal computer. Businesses that sell services across.

Delaware Hawaii New Mexico and South Dakota tax most services. The Taxation and Revenue Department serves the State of New Mexico by providing fair and efficient tax and motor vehicle services. This tax is imposed on persons engaged in business in New Mexico.

The Mission of the New Mexico Judiciary is to protect the rights and liberties of the people of New Mexico guaranteed by the Constitution and laws of the State. What is taxable. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of.

Average Local State Sales Tax. While New Mexicos sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Ad E-File Federal to the IRS for Free and Directly to New Mexico for only 1499.

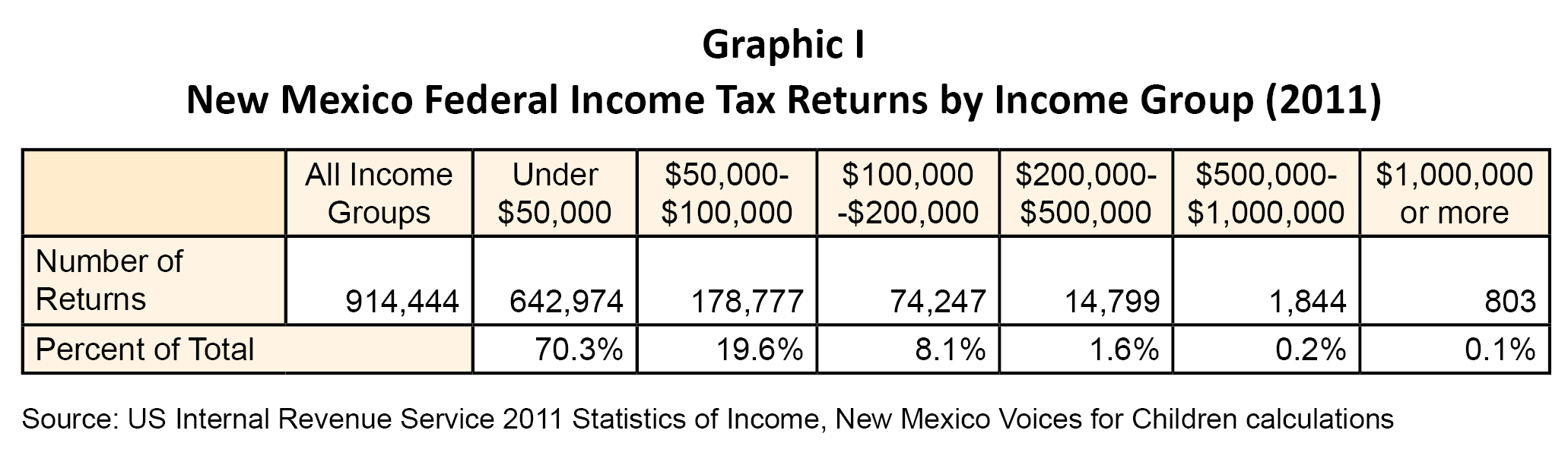

Call Center Customer Service Rep. Ad 2023 updated information on New Mexico State Taxes with resources forms. 9 The individual income tax rates are listed in the table below.

The New Mexico State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 New Mexico State Tax CalculatorWe also. Compensating tax Section 7-9-7 NMSA 1978 is an excise tax imposed on persons using tangible property services licenses or franchises in New Mexico. This page describes the taxability of.

National Register Of Historic Places Listings In New Mexico Wikipedia

Tas Pre Filing Season New Mexico Taxpayer Advocate Service

Pay Your New Mexico Small Business Taxes Zenbusiness Inc

Historical New Mexico Tax Policy Information Ballotpedia

Nm Thrives Joins Irs To Highlight Charitable Tax Benefit Available

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children

Free Income Tax Preparation To Begin El Defensor Chieftain

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children

New Mexico Sales Tax Small Business Guide Truic

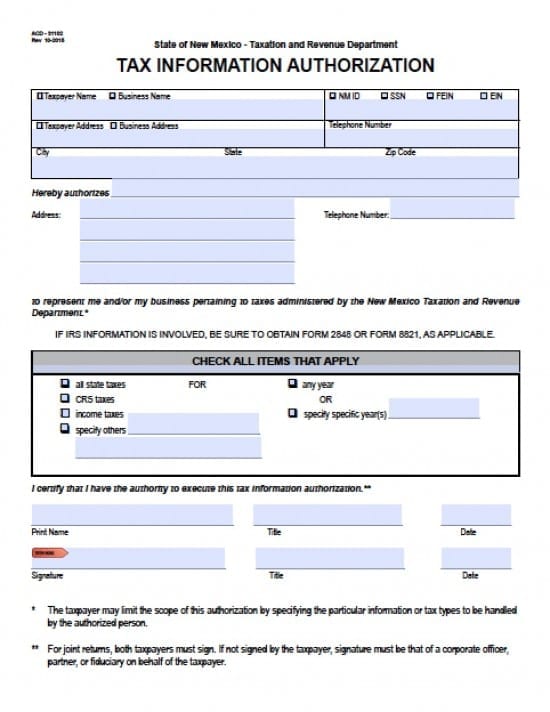

New Mexico Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

Bubba S Tax Service Aztec New Mexico Painting By Janet Kruskamp Fine Art America

City Of Albuquerque Hosts Free Tax Help Krqe News 13

State And Local Sales Tax Rates Midyear 2022

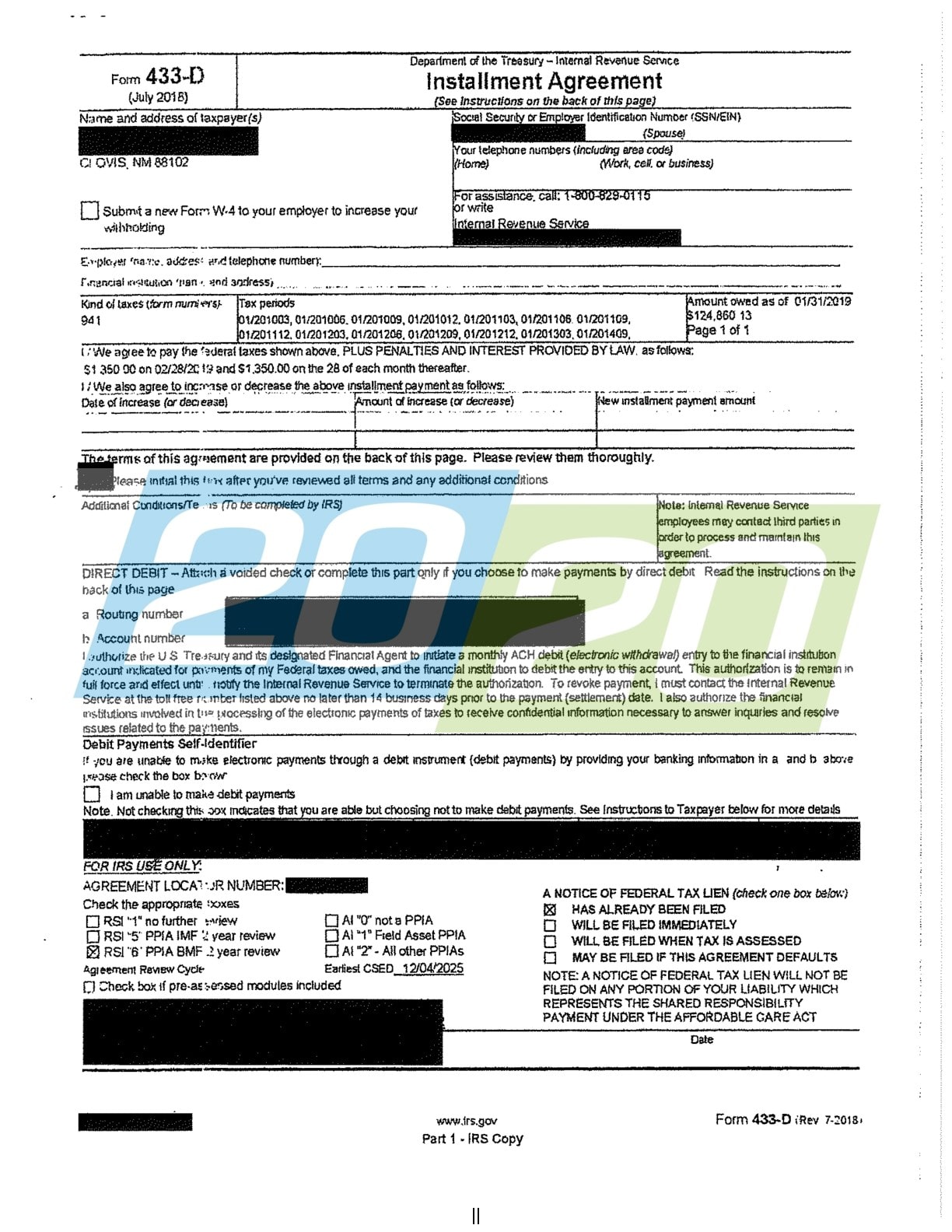

Tax Problems Settled New Mexico 20 20 Tax Resolution

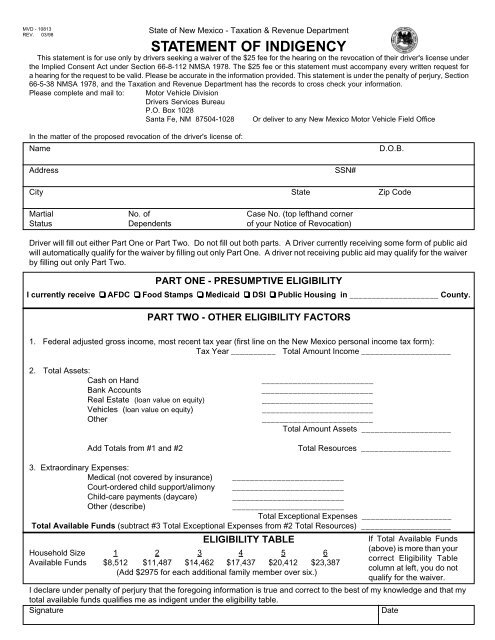

Statement Of Indigency Mvd10813 A One Title Service

How To File And Pay Sales Tax In New Mexico Taxvalet